🏛 What Is Probate — And Why Do So Many People Try to Avoid It?

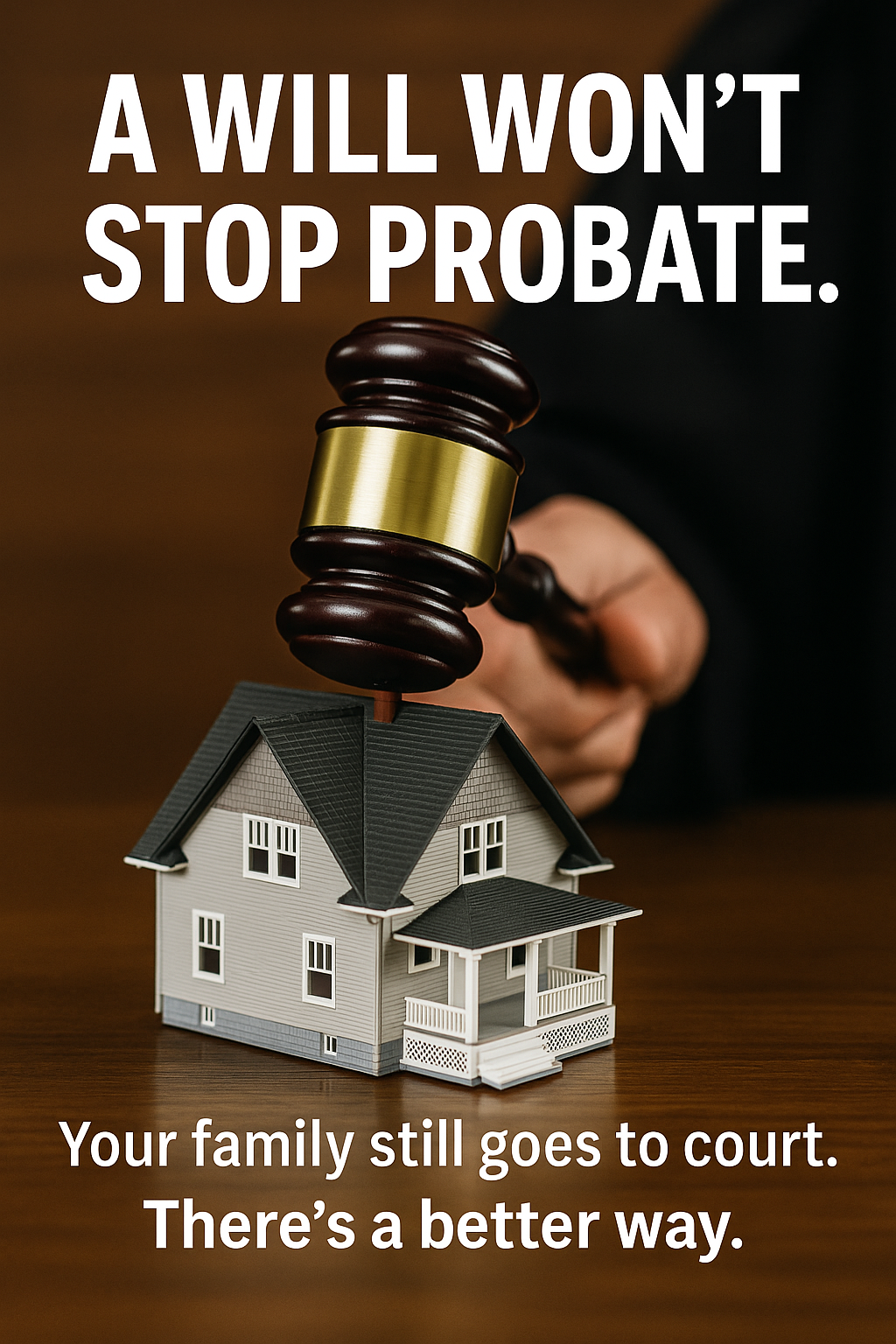

When someone passes away, their assets don’t just automatically transfer to the right people — even if they had a will. In most cases, the estate must go through probate first.

Let’s break down what probate is, why families try to avoid it, and how a living trust can make things faster, simpler, and much more secure for your loved ones.

❓ So What Is Probate?

Probate is the legal process where the court:

- Verifies your will (if you have one),

- Appoints someone to manage your estate,

- Handles any debts or claims,

- And oversees the distribution of your assets.

Even in smaller estates, the court still gets involved. There's still waiting, paperwork, and legal fees. And if things aren’t crystal clear — or someone contests your plan — it can get messy fast.

🚧 Why Probate Is a Headache

- It’s slow. Even a simple probate can take 6–12 months, and more if there’s a dispute.

- It’s expensive. Attorney fees, court costs, appraisals, and executor fees can eat up 5–10% of the estate.

- It’s public. Probate files are part of the public record — anyone can see what you owned and who got what.

- It’s stressful. Your family may be dealing with delays, frozen accounts, and legal confusion at the worst possible time.

One simple mistake in your estate plan could cost your family thousands.

Before you assume your will is “good enough,” read this free guide — and make sure you’re not walking straight into probate court.

⚠️ Download: 7 Estate Planning Mistakes That Could Cost Your Family Everything

✅ How a Living Trust Avoids Probate

A revocable living trust is a powerful legal tool that lets you keep your assets out of probate completely.

Here's how it works:

- You create the trust and move your assets into it.

- While you’re alive, you stay in full control as trustee.

- When you pass, your chosen successor steps in and follows your instructions — no court approval needed.

The result? No probate, no delays, no drama.

💡 Bonus Benefits of a Living Trust

Avoiding probate is just the beginning. A trust also gives you options and protections that a will can’t:

🔐 Creditor & Divorce Protection for Your Heirs

With the right language, a trust can protect your children’s inheritance from lawsuits, divorces, or poor financial decisions.

⏳ Staged Distributions

You don’t have to give everything to your kids at 18. A trust lets you delay or stagger distributions — like 25% at age 25, 50% at 30, and the rest at 35 — or tie them to milestones like finishing school.

♿ Supplemental Needs Protection

If you have a child or loved one with a disability, you can include a special needs clause to protect their inheritance without jeopardizing their government benefits.

🏡 Preserve the Family Property

Want to keep the lake house, deer camp, or family cabin from being sold off or fought over? A trust can:

- Keep the property in the family,

- Assign someone to manage it,

- Set rules for usage, repairs, or buyouts.

This is a great way to preserve memories and avoid family fights — especially here in the Ozarks.

A will doesn’t avoid court — it guarantees it.

Without the right trust in place, your loved ones could face months of legal delays, thousands in court fees, and total loss of control over your estate.

🛑 Avoid Probate Headaches — Book Your Free Trust Consult

👨👩👧 Real People Use Trusts — Not Just the Wealthy

This isn’t about offshore accounts or billionaire tax shelters. A trust is just a smart, efficient way to:

- Pass on your home,

- Protect your family,

- Avoid unnecessary court costs,

- And make sure your wishes are followed exactly.

If you own a home, have kids, or just want to keep things simple for your family — you’re trust material.

📌 Final Thoughts

A will is a start — but it’s not a plan. If you want:

- Less stress for your family,

- More control over your legacy,

- And better protection for the people you love...

A living trust is the smart way to do it.

📄 Learn How To Save Your Family From Headaches and Losing Thousands

Find this article helpful? Go to our blog ozarktrustandestate.com/blog/

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Reading this blog does not create an attorney-client relationship. For personalized legal guidance, please contact Ozark Trust and Estate directly.